Owning bitcoin is a superpower. Over time, it changes your mindset — and your financial reality.

Instead of watching your money lose value to inflation, you begin to see it grow. Hold bitcoin long enough, and you’re no longer just trying to get by — you’re building real, lasting wealth.

Bitcoin gives you the tools to thrive financially, with the kind of long-term growth fiat could never offer.

It’s also a giant middle finger to the banking system and the government’s fiat currency — systems that have quietly eroded people’s wealth for generations.

Bitcoin has a way of turning spendthrifts into radical savers. You start measuring your net worth in sats, not dollars. That new phone you bought in 2020? It sure seems like a rather expensive device when priced in bitcoin instead.

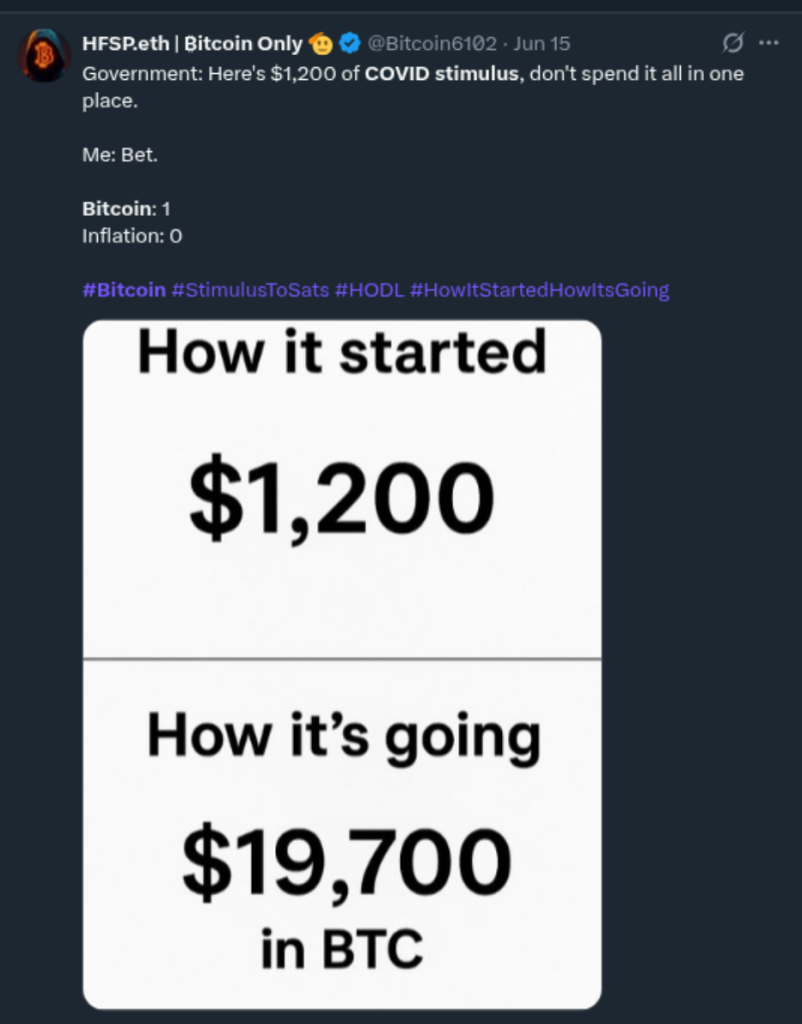

Just look at what happened to the COVID stimulus checks — what seemed like “free money” at the time could’ve become so much more if converted to Bitcoin and held.

Let’s say you bought bitcoin with your COVID stimulus money in April 2020. How much would that be worth today, just over 5 years later?

Well, look at that. An increase of 1500% in only 5 years. Bitcoin has performed this way for its entire history, and according to hardcore bitcoiners, it’s going up forever.

So if you’ve been investing your monthly surplus into Bitcoin, there may come a time when you want to enjoy the rewards of your foresight — without sacrificing the privacy you’ve worked hard to protect by buying anonymously and learning to transact privately.

Now the question is, what can you buy with bitcoin? And what’s the most efficient, and private way?

In this article, we’ll look at some of the best ways to spend bitcoin without KYC (no ID verification) and I will show you how many options you have in 2025.

Aqua Wallet’s New Dolphin Visa Card

Aqua Wallet is one of the best self-custody bitcoin wallets that exists today. You can save and spend bitcoin using a combination of on-chain, lightning and liquid.

On-chain bitcoin refers to transactions that are recorded directly on the Bitcoin blockchain — the public ledger that tracks all Bitcoin movements. This is a normal, “layer 1” bitcoin transaction. The transaction fees are typically higher than lightning/liquid, and transactions are much less private.

Lightning and liquid, known as “layer 2” bitcoin, are the best ways to spend bitcoin in 2025. They are cheaper and more private.

Aqua’s Dolphin Card is a prepaid Visa debit card that you can use for many online purchases.

It is a non-KYC way to spend your bitcoin, so none of your purchases will be tied to your name. For this, they charge a 1% fee for every transaction.

I’ve been waiting many years for something like this, and so far, I’m impressed.

Whenever I want to make a purchase, I will send bitcoin from my Coldcard hardware wallet to the Aqua Wallet to fund my Dolphin card, and use it for the majority of my online purchases.

Aqua’s Dolphin Card is still in beta, but soon it will be widely available, and there will even be a physical card for in-store purchases.

Unfortunately, some stores still don’t accept prepaid cards like this one, and it isn’t available in some countries so your mileage may vary.

But if you can use it, Aqua’s Dolphin Card is a fantastically private way to use your bitcoin for online purchases.

Bitrefill

Bitrefill is a very useful alternative to the Dolphin Card. You can buy anonymous gift cards for many of the biggest retailers in the world. Walmart, Amazon, Uber, Home Depot, AirBNB, Target, Safeway, Steam and many more. If you’re in the US, you can also buy a prepaid Visa gift card, similar to the Dolphin Card.

It’s the most popular way to spend bitcoin for good reason. You can buy gift cards to use anywhere in the world, and they accept both bitcoin and lightning.

Bitrefill is like buying gift cards for cash — cheap and private. You don’t even need to make an account or use an email address. And if you pay with lightning, you get your gift card code immediately.

All you have to do is choose the fiat value of the gift card you want to buy from Bitrefill.com and select between on-chain and lightning bitcoin.

Scan the QR code with a wallet like Aqua, Phoenix or Bull Bitcoin, send the payment, and you will receive the card immediately (with lightning), or once your bitcoin transaction has been confirmed (if you pay on-chain).

It’s so ridiculously easy. You might even start feeling angry about all your inefficient and restrictive past banking experiences.

This is why we buy and spend bitcoin — to free our wealth from the banking prison.

Spending Bitcoin Locally

Depending on where you live, you may be surprised to see how many local stores accept bitcoin. And why shouldn’t they accept the best form of money ever known to man?

Whether they hodl the bitcoin or immediately convert it to fiat, there’s absolutely no downside for them. It’s a great way to invite bitcoiners to their store.

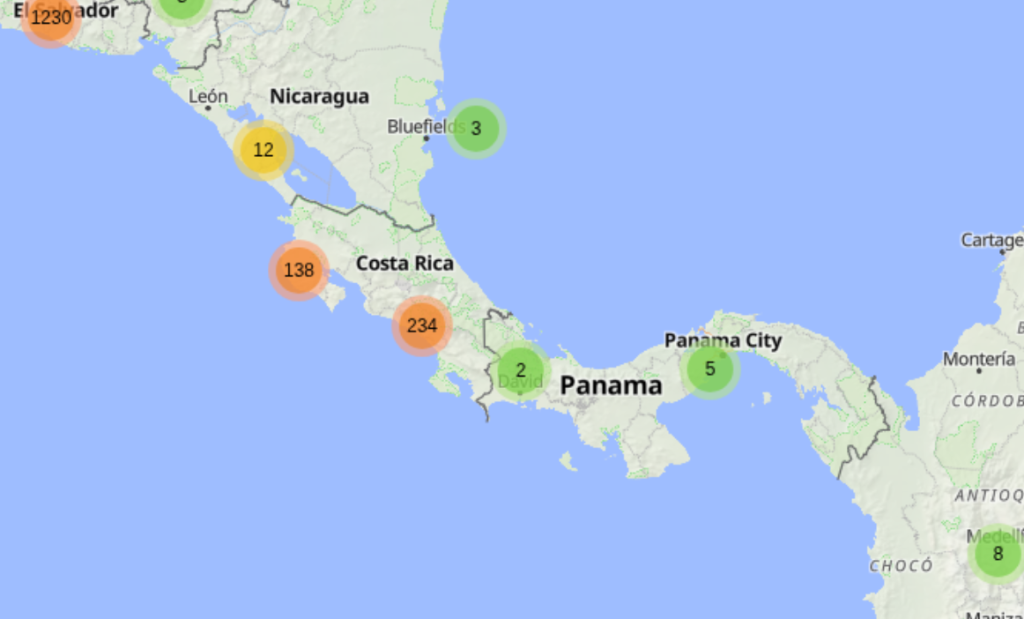

If you’d like to find these businesses, visit btcmap.org. Here’s an example. I just opened the map and took a look at Central America.

And what the heck is going on in Costa Rica? So many businesses there accept bitcoin! That’s what happens when bitcoiners build a circular economy.

A bitcoin circular economy is a system where individuals and businesses earn, spend, and save in bitcoin without needing to convert it into traditional currencies. It promotes self-sustaining economic activity entirely within the bitcoin ecosystem.

In Costa Rica, a community-driven organization called The Bitcoin Jungle has been promoting the use of bitcoin by locals, tourists and expats. They are based in Costa Rica’s “Golden Triangle” which includes the towns of Uvita, Ojochal, Dominical and more.

This is a place where you can live entirely on The Bitcoin Standard.

Bitcoin circular economies will continue to grow as more people recognize its superiority over fiat currency.

Another example is Bitcoin Beach in El Salvador, one of the first circular economies. Even in Canada, adoption is growing — in Vancouver alone, over 90 businesses now accept bitcoin. Check the map to see how many businesses in your area accept bitcoin.

This is a grassroots movement, and you can be part of it. If you want a business to accept Bitcoin, just ask — you might be surprised by who says yes.

Tools for Digital Privacy – Paid with Bitcoin

While most major retailers still don’t accept Bitcoin, there are many products and services you can purchase directly with it. For the most part, these products and services are privacy-focused. These days, privacy-oriented companies seem to be among the few that respect their customers enough to accept bitcoin. Let me show you the products and services I use.

- Mullvad VPN – Still the only VPN I’ve found that truly respects your anonymity — no account, no email, just an account number. Especially if you’re a bitcoiner, it’s essential to encrypt your internet usage and helpful to adopt an IP address from a different country. They accept both on-chain and Lightning Bitcoin payments.

- Tuta Mail – This email service is very private, and they make it easy to pay with Bitcoin. They’ve partnered with proxysto.re to sell their premium service via gift card, which you can pay for directly with Bitcoin. This is the email provider we use for our website.

- Cryptomator – Also available on proxysto.re, Cryptomator is software you should use to encrypt all personal documents on your computer. This way, if anyone gains access to your device, they won’t be able to see your sensitive personal information. Cryptomator is free on desktop, but you can support them by buying a license for their Android app. You can also use Veracrypt, a free service, to encrypt entire drives, external hard drives, or flash drives. K3tan’s written an excellent blog post on Cryptomator if you’d like to learn more.

- Brax.me – This company, run by popular YouTuber Rob Braxman, accepts Bitcoin payments for various services like VPNs, email, and VOIP numbers. Their VOIP service is fantastic for receiving texts and making calls without KYC (Know Your Customer).

- Sync.com (encrypted cloud storage) – You can ditch iCloud and Google Drive since they don’t respect your privacy. Sync isn’t quite as user-friendly as these big tech cloud storage options, but it uses end-to-end encryption and accepts Bitcoin for payment.

- Silent.Link – Use this service to buy a no-KYC eSIM card for your phone. You can get data-only plans or options with a phone number for SMS. Silent.Link gives you access to data worldwide without handing over your personal information. Prices are as low as $1–$2 per GB.

- Textverified – The OG SMS verification service where you can load your account with Bitcoin to get temporary phone numbers for all those invasive companies that require phone verification for registration.

- Coldcard – Still the #1 hardware wallet you can buy and worth every satoshi. Coldcard’s Q and MK4 are both excellent, feature-rich options for storing your Bitcoin without ever touching an internet-connected device. The Q model is especially user-friendly thanks to its QR code reader and full QWERTY keyboard.

- Start9 – If you dive deep enough into Bitcoin, you might want to run your own node. Start9 has developed an operating system that’s perfect for building a plug-and-play server. Their Server One and Server Pure are powerful computers that let you run a Bitcoin node, Lightning node, self-hosted cloud storage, and more.

- Parmanode.com – @parman_the on Twitter sells a variety of Bitcoin privacy products, including nodes, signing devices (hardware wallets), and server computers built from new and refurbished laptops. One of the best features of his hardware wallets is their incredible discretion — it’s just a laptop!

Luxury Bitcoin Products

Once you hodl bitcoin long enough, you might feel like rewarding yourself some beautiful artisanal products. Here are my recommendations:

- The Leather Mint – If you haven’t seen one of these wallets, you’re missing out. This store runs fully on the Bitcoin standard — you can only pay with Bitcoin (on-chain or Lightning). They craft stunning, luxurious leather goods including wallets, belts, Coldcard cases, and bracelets. Many of their wallets are made from high-end Cordovan leather, sourced from a small artisan tannery in Japan.

- Art by Madex – The creative genius behind Bull Bitcoin’s branding and graphic design, Madex is a true master of his craft. He creates fine art and regalia necklaces, available through his store at madex.art or directly from him at Bitcoin conferences.

Conclusion

If you value privacy and understand Bitcoin, you can take a real step away from the traditional banking system. Sell your dollars, buy Bitcoin, hold it securely, and spend it privately. Done right, it can be almost as private as cash, and there are plenty of ways to spend it — just make sure you’re always buying or earning back more. It would be a shame to enjoy cool things at the expense of your future Bitcoin stack.

But remember, Bitcoin isn’t truly anonymous, and privacy can never be bulletproof. It’s pseudonymous, meaning your Bitcoin address can be linked to your real identity if you slip up. That’s why I usually recommend using the Lightning Network for most transactions — Lightning payments aren’t recorded on a public ledger forever, offering better privacy.

Even though bitcoin privacy is imperfect, traditional finance can be so much worse…

When you use your credit card online, you’re exposing yourself to identity theft. Plus, Visa and Mastercard track your every move and likely sell your data. Breaking free from the big tech and banking prison we’re all trapped in can earn you a great deal more personal freedom.

So buy Bitcoin privately, learn to secure it, spend it anonymously in various ways, and set your financial life free.

If you’re ready to buy bitcoin, I recommend visiting a bitcoin ATM with limited-KYC near you (find one at coinatmradar.com, look for SMS verification only and use one of the SMS services I mentioned in this article) or buying from an exchange that respects your privacy. All exchanges require KYC to some extent, but some are better than others. Stay away from the big exchanges like Coinbase and Binance unless you want your data on the dark web and your privacy compromised forever.

If you’re in the USA, I generally recommend looking into River.com or Bitcoinwell.com, but in Canada and Europe (and Mexico and Costa Rica), Bull Bitcoin is the best exchange.

Bull Bitcoin is bitcoin only, so if somehow my article has convinced you to buy an altcoin, look elsewhere.

But if you want bitcoin, Bull offers many useful features:

- Best-in-class customer service – unlike most large exchanges, you get to speak to a real human being.

- Multiple ways to fund your account – Bank transfers, e-transfers, SEPA, or even buy with cash in-person at Canada Post.

- Lightning, Liquid and DCA – Save on fees and increase privacy with bitcoin buys and on lightning and liquid networks. You can even set up hourly, daily or weekly dollar-cost-average buys.

- Pay Bills with Bitcoin – You can sell bitcoin directly to any credit card, bank account, or bill payment invoice. Bull Bitcoin allows you to live on a Bitcoin Standard.

- Respect For Your Privacy – Bull Bitcoin never sells your personal information to governments or chain analysis companies.

If you’d like to make your first purchase on Bull Bitcoin, use my referral link to save 0.25% on all bitcoin buys, and help me get a small commission to stack a few extra sats.