Whether you’re a new or experienced bitcoin investor, you might be unsure about how to manage your bitcoin investment in 2025. Is the price going to explode, or has it already topped out?

Well, here’s 3 magic words for you to study, memorize and build your investment around:

It doesn’t matter.

I will make the argument for why this is true, how the experts are investing and what you can do to enjoy bitcoin’s maximum potential in the years to come.

Bitcoin’s Price Doesn’t Matter

Why would you buy bitcoin? For many people, it’s to accumulate more dollars, but the purpose is different for a sovereign individual. Sure, you want to increase your purchasing power and that’s why you need to hodl bitcoin in the first place. But it isn’t about maximizing your dollar profit.

Fiat currency is a lost cause. The dollar is going to zero — just like every other fiat currency that’s ever existed. This is inevitable when governments and central banks are in control of the money supply. Money printing, or inflation, is the process they use to maximize government revenue by devaluing your savings. They make savers poor in order to fund warfare, welfare and propaganda (i.e. public school education).

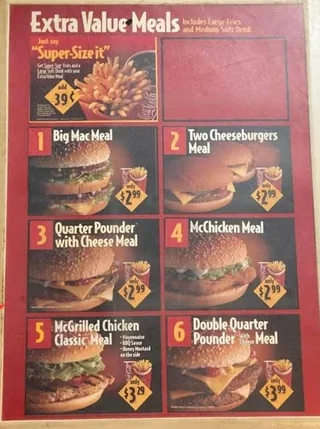

Look at this 1990s McDonald’s menu for example.

Today, everything on the menu is ~350% more expensive. Houses and cars are unaffordable for young families and household debt is at an unsustainable level — just so the average family can survive.

Bitcoin is how we stop the theft. When you hold bitcoin in self-custody, the government can’t steal it, through inflation or otherwise. So why would you care about the short term USD price of bitcoin?

Instead, you need to look at the medium to long term trend. Then you’ll see the reality — bitcoin is always going up.

Sure, you would benefit even more if you always bought the dips, but look at what happened in 2017 on this chart. Today, it looks like a tiny price bump, but back then, it was a 20x increase from $1000 to $20,000. If the price is going up forever, and short term action is inconsequential, then how should you invest in bitcoin?

Buy Early and Hodl

Imagine if someone convinced you to buy bitcoin back in 2017. They told you which wallet to download and how to buy it and you simply followed their lead. What would have happened?

You could have purchased some bitcoin in June for $2400 or at it’s December peak of ~$19,000. It would have hurt like hell if you bought the top and experienced a paper loss of over 80%, but bitcoin’s done incredibly well since then.

If you ever made a mistake and bought the top, all you’d have to do is keep buying, hold through the pain for 3 or 4 years, and you’d be golden. For example, 4 years after the $19,000 peak in 2017, the bitcoin price was around $50,000. And today, almost 8 years after the 2017 peak, 1 bitcoin is near its all time high at $108,000.

If you’re going to make a bitcoin investment in 2025, forget about the USD price for a few years. Think big. What do you think the price will be in 2029? Bitcoin is the most scarce resource that’s ever existed and soon enough, everyone is going to want some. What will that do to the price?

If you’re going to invest in bitcoin, just be patient and focus on the trend. If you’re thinking too short term, and you’re nervous about price action, remember this expression:

When in doubt, zoom out

Zoom out and look at the long term trend instead of what’s happening over days or weeks.

How the Experts Are Investing in Bitcoin

Way back in 2018, when the bitcoin price was $3500 USD, Bob Loukas released his first video on the bitcoin 4-year journey. He described the 4-year cycle, a common pattern observed in asset price action, especially bitcoin.

This cycle begins when bitcoin hits the bottom of a bear market. Price is low, and sentiment is poor. The last time this happened was in late 2022 when the price was sitting around $16,000 (75% down from the 2021 high of $65,000). Fear was high and sentiment was extremely negative. Some people even thought bitcoin was dead.

And yet, the USD price almost tripled in 2023, before reaching the unimaginable price of $100,000 in 2024.

That’s the way the 4-year cycle works.

- Year 1: Sentiment is low, many people think bitcoin is dead.

- Year 2: Sentiment and price gradually increase while investors accumulate cheap bitcoin.

- Year 3: The year of the bull market, which has historically resulted in a euphoria-driven blow off top.

- Year 4: A great bitcoin price decline of ~80%.

Most people do very poorly during their first or second 4-year cycle, but if you stay focused, you don’t have to make the same mistakes.

Bob Loukas usually buys a lot of bitcoin at the bottom and holds until year 3, as near to the blow off top as possible. Then he sells a portion of his holdings and tries to buy back even more at the next low. You can watch his first video for a more detailed explanation.

How Should You Manage Your Bitcoin Investment?

Do you want to follow Bob Loukas and try to maximize your bitcoin holdings by timing the 4-year cycle? Maybe this is the best strategy for you.

But some people, myself included, feel a little gross when exiting a bitcoin position for fiat. You end up with a large amount of cash in your bank account, and a massive capital gains tax bill. Perhaps you’re wealthier at the end of the day, but as a sovereign individual, you might prefer to just buy and hold forever.

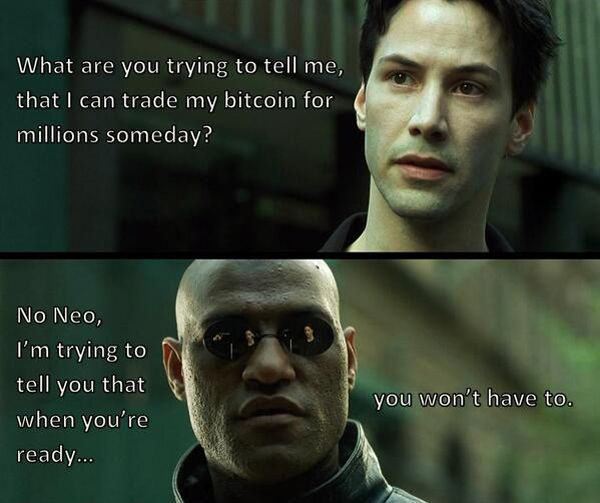

Have you seen this Matrix bitcoin meme?

It’s a stone cold classic, and it illustrates a beautifully optimistic outlook on bitcoin’s future.

If fiat currency is going to 0 and bitcoin is going up forever, there will be a time in the future when you don’t have to sell your bitcoin for dollars. Bitcoin is the ultimate form of money, and everyone will be forced to accept it someday. Why would you sell? What if you accidentally mistime the market?

So don’t bother worrying about the price. Forget about charts and all the technical analysis noise on youtube. You can certainly try trading your way to bitcoin riches, but you don’t have to. When you hold fiat currency, you absolutely must gamble just to stay ahead of the constant pillage of inflation, but bitcoin is different.

With bitcoin, all you have to do is work, save and learn.

The Ultimate Bitcoin Investment Strategy

Ultimately, everyone has to choose how they invest, but holding bitcoin is a superpower for the sovereign individual.

So if you’d like to buy and hold bitcoin without the stress, consider this — just buy and hold and don’t worry about the price.

If the price goes down, buy some cheap bitcoin and if the price goes up, buy more anyway. Spend it too when you can. Buying goods and services with bitcoin is an amazing experience.

If you’d like to time the market, study Bob Loukas’ videos on youtube, but if you just want to buy, hold and learn, here’s what you need to do.

- Download one of the top bitcoin wallets and buy a Coldcard hardware wallet to keep your holdings secure.

- Buy some bitcoin privately from an atm or peer-to-peer exchange. Alternatively, buy bitcoin from a KYC exchange that respects your privacy.

- Learn as much as you can about bitcoin and continue investing accordingly.

Take your time, stay calm and never invest emotionally. No FOMO or panic selling.

As a sovereign individual, understand that when you get into bitcoin, you are choosing to take full responsibility over your wealth. Take it seriously and free your wealth from its banking prison.

Next Steps

- Read this bitcoin security guide

- Download a wallet from this list

- Learn how to buy bitcoin anonymously

If you’re ready to buy bitcoin, I recommend visiting a bitcoin ATM with limited-KYC near you (find one at coinatmradar.com, look for SMS verification only and use one of the SMS services I mentioned in this article) or buying from an exchange that respects your privacy. All exchanges require KYC to some extent, but some are better than others. Stay away from the big exchanges like Coinbase and Binance unless you want your data on the dark web and your privacy compromised forever.

If you’re in the USA, I generally recommend looking into River.com or Bitcoinwell.com, but in Canada and Europe (and Mexico and Costa Rica), Bull Bitcoin is the best exchange.

Bull Bitcoin is bitcoin only, so if somehow my article has convinced you to buy an altcoin, look elsewhere.

But if you want bitcoin, Bull offers many useful features:

- Best-in-class customer service – unlike most large exchanges, you get to speak to a real human being.

- Multiple ways to fund your account – Bank transfers, e-transfers, SEPA, or even buy with cash in-person at Canada Post.

- Lightning, Liquid and DCA – Save on fees and increase privacy with bitcoin buys and on lightning and liquid networks. You can even set up hourly, daily or weekly dollar-cost-average buys.

- Pay Bills with Bitcoin – You can sell bitcoin directly to any credit card, bank account, or bill payment invoice. Bull Bitcoin allows you to live on a Bitcoin Standard.

- Respect For Your Privacy – Bull Bitcoin never sells your personal information to governments or chain analysis companies.

If you’d like to make your first purchase on Bull Bitcoin, use my referral link to save 0.25% on all bitcoin buys, and help me get a small commission to stack a few extra sats.

Leave a Reply