Why is the USD price of bitcoin going up forever, and how can this help you achieve family financial sovereignty and become a better parent? Give me a few minutes, and I’ll explain exactly why this is happening—even in July 2025, with Bitcoin at $118,000.

The Difficulties of the Modern Economy

Have you noticed how unaffordable the basics have become for young families over the past decade? A home in a major city—or even in the suburbs—is often out of reach for a single-income household.

But here’s the problem: a dual-income setup is deeply at odds with raising children, especially for families seeking sovereignty. You can’t be sovereign and raise happy, self-reliant children if both parents are gone all day. Kids need their parents present. The alternative many parents choose is to send their children to daycare and public school.

Babies and toddlers who spend their time in daycare have their hearts broken. And children in public school often have their souls and imaginations crushed.

So it becomes your responsibility to be there—to raise and educate your own children. But in today’s economy, how are you supposed to make that happen?

Having kids is life’s greatest pleasure and purpose. It’s easy enough to have them—but what’s hard is setting your family up to thrive financially.

In order to do this, you’ll have to break all the conventions.

As I explained in my “Bitcoin Investment Strategy” post, fiat currency is a rigged game you’re better off not playing—and today, there’s a way out.

Bitcoin For the Sovereign Family

Your boomer parents probably told you that owning a home is virtuous and financially wise. Of course they did—that’s how they beat inflation. But now they’re convinced, almost by default, that a house is an investment.

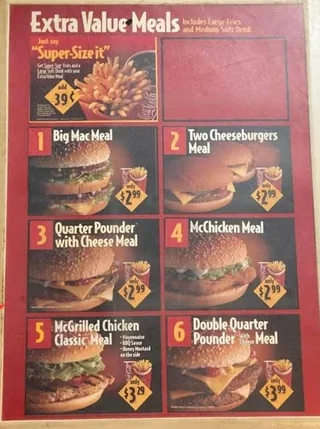

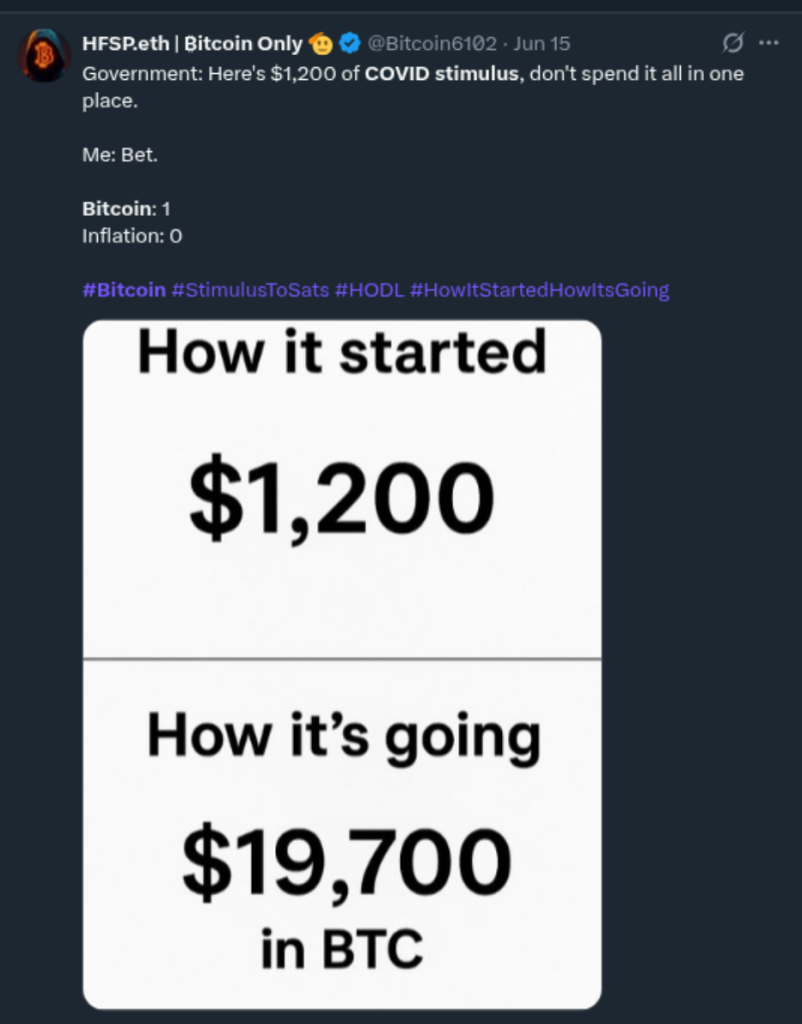

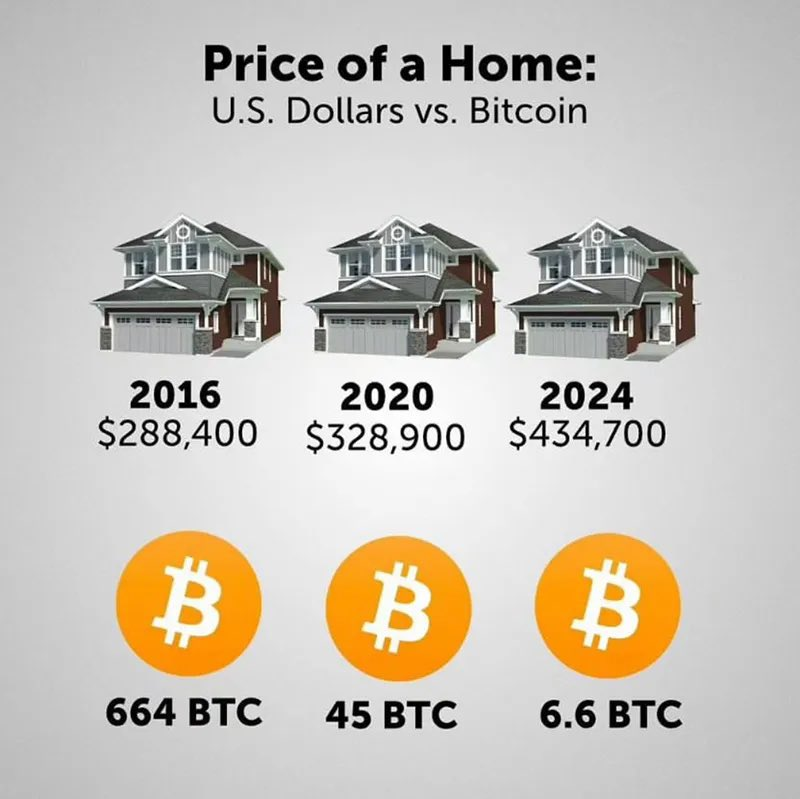

Take a look at the picture below. While the average home price in America has steadily risen, Bitcoin holders have seen their purchasing power grow far more dramatically.

After all, Bitcoin has a very low inflation rate and a very limited supply. That’s why a house cost hundreds of Bitcoin just nine years ago. But today, with Bitcoin at $118,000, you can buy the same house for less than 5 BTC. How much Bitcoin do you think you’ll need to buy that house in 2029?

When you invest in the traditional financial system and live a debt-based lifestyle, it can be hard to outpace inflation and save a substantial amount of money. You’re basically forced to gamble in the stock market just to keep your wealth from being eaten away by inflation.

But bitcoin has proven itself unequivocally as deflationary money and a powerful way to build wealth. Especially if you’re an early adopter, which you can still be in 2025, you can grow your wealth exponentially.

Bitcoin and Parenting

If you buy bitcoin with your fiat savings and grow your wealth, what will that mean for your family?

The modern Westerner is propagandized into believing that children are expensive, but the truth is that taxes are extremely high and the financial system is rigged. And that’s why everything’s getting so unaffordable.

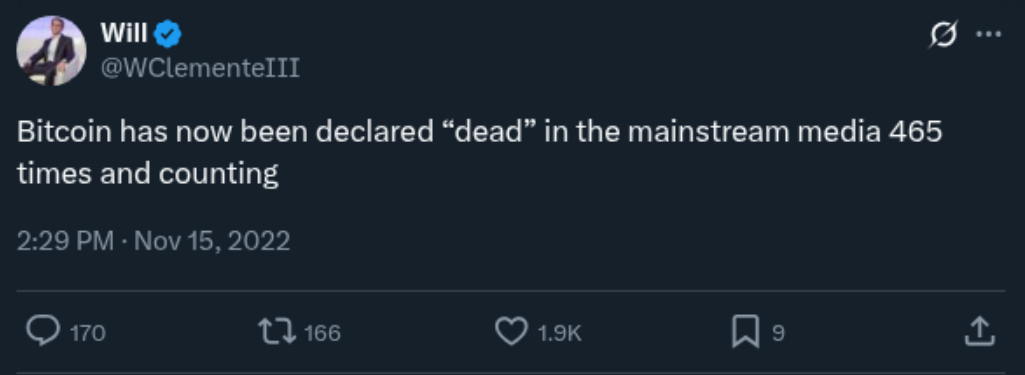

The whole system is designed to steal from and demoralize us. But hold bitcoin for a few years, and you will become radically more optimistic about your future.

Check out this video by Forrest Hodl of “Bitcoin Not Crypto”. He talks about how bitcoin helped him imagine a world where things are actually getting cheaper, especially if you acquire bitcoin early.

Bitcoin gave him hope for the future, and “you have to have hope for the future to bring somebody into the world.”

Forrest creates a ton of quality content on Youtube, and his video, as well as my own experience, inspired this post.

Bitcoin and Housing

All of a sudden, your 5-figure nest egg has grown to 6 or even 7 figures, and you’re no longer trapped in a pit of debt. You might even be able to bypass the most common debt instrument, the mortgage, and buy a house in cash. Or at least you’ll be able to reduce your mortgage with a more substantial down payment.

Do you know how much a mortgage really costs? If you buy a $700,000 home in Canada, you’ll end up paying around $400,000 in interest over the life of the mortgage.

Mortgages are really expensive! But so is dropping $700,000 in cash to buy a house. You might be better off just renting, but that’s your decision to make.

The reason I mention housing is because this is the biggest expense that any family needs to work out. Your kids need a place to live. But if you grow your wealth exponentially with bitcoin, you’ll be able to relax and have as many kids as you want.

No more worrying about the cost of your beautiful children, and no more needing to forgo family formation altogether as a reaction to the rigged financial and tax system.

With bitcoin, you can focus on what matters, instead of agonizing over your investments and spending your whole life working without saving.

Your kids just want to exist and spend time with you, but this is threatened by high taxes and inflation. So I encourage you to study bitcoin and money, and make moves that will allow you to have kids and spend as much time with them as they need.

How To Have Your Sovereign Family

Bitcoin can ease your family’s financial stress and support financial sovereignty—an essential step toward true independence.

If you grew up with parents who were constantly stressed or preoccupied with money, you likely remember how deeply that affected your sense of well-being.

Today, with the cost of living soaring and household debt at record highs, financial sovereignty is more crucial than ever. If Bitcoin offers a solution to inflation and long-term wealth preservation, it can free you and your spouse to focus on the other vital aspects of family sovereignty—like health, education, and values.

Sovereignty Over Birth, Health, and Education

You can focus on how to be medically sovereign by doing your own research, especially about childbirth. You don’t need to blindly submit to the opinions and manipulations of medical professionals. It’s your family and you need to be able to make informed decisions on birth, health and wellness.

Read more on birth sovereignty here.

Once you have children, you can choose how to parent and educate them—rather than leaving it up to the State. It’s every parent’s nightmare to spend all day, five days a week, rushing kids off to school while working themselves to the bone, never seeing the results they need in order to truly thrive. The dual-income life is incredibly stressful and often joyless. Bitcoin fixes this.

You can take charge of your children’s education and actually enjoy more time with them—every single day.

And if you’re thriving financially, you won’t be so stressed that you snap at your children—or worse. You and your spouse can calmly define your parenting values and raise your children in a peaceful home, free from constant conflict. Bitcoin can free up your emotional bandwidth, allowing you to spend less time worrying about investing and more time focused on your children.

Money is our life’s energy—it’s stored time. When the government and financial system steadily erode its value, it pushes parents into survival mode. Bitcoin puts the power to save and build wealth back in your hands. By embracing Bitcoin, you take a vital step toward family financial sovereignty. If you put in the work to deeply understand it, you can reclaim your sovereignty—and raise happy, healthy children.

Next Steps

- Read this bitcoin security guide

- Download a wallet from this list

- Learn how to buy bitcoin anonymously

- Research bitcoin investment strategies and top bitcoin mistakes you need to avoid

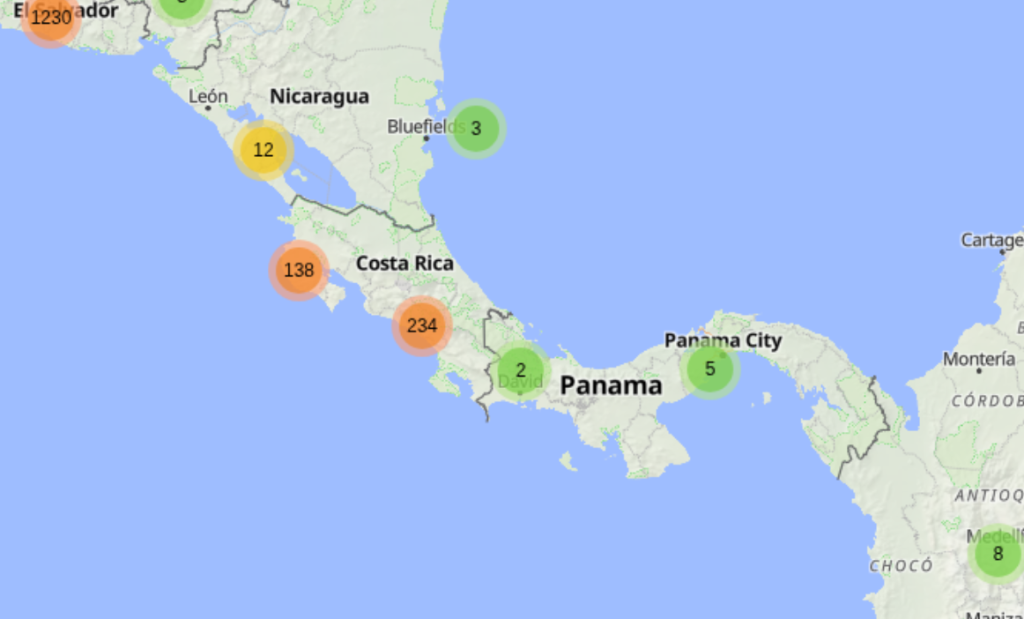

If you’re ready to buy bitcoin, I recommend visiting a bitcoin ATM with limited-KYC near you (find one at coinatmradar.com, look for SMS verification only and use one of the SMS services I mentioned in this article) or buying from an exchange that respects your privacy. All exchanges require KYC verification to some extent, but some are better than others. Stay away from the big exchanges like Coinbase and Binance unless you want your data on the dark web and your privacy compromised forever.

If you’re in the USA, I generally recommend looking into River.com or Bitcoinwell.com, but in Canada and Europe (and Mexico and Costa Rica), Bull Bitcoin is the best exchange.

Bull Bitcoin is bitcoin only, so if somehow my article has convinced you to buy an altcoin, look elsewhere.

But if you want bitcoin, Bull offers many useful features:

- Best-in-class customer service – unlike most large exchanges, you get to speak to a real bitcoiner who can walk you through the process.

- Multiple ways to fund your account – Bank transfers, e-transfers, SEPA, or even buy with cash in-person at Canada Post.

- Lightning, Liquid and DCA – Save on fees and increase privacy with bitcoin buys and on lightning and liquid networks. You can even set up hourly, daily or weekly dollar-cost-average buys.

- Pay Bills with Bitcoin – You can sell bitcoin directly to any credit card, bank account, or bill payment invoice. Bull Bitcoin allows you to live on a Bitcoin Standard.

- Respect For Your Privacy – Bull Bitcoin never sells your personal information to governments or chain analysis companies.

If you’d like to make your first purchase on Bull Bitcoin, use my referral link to save 0.25% on all bitcoin buys, and help me get a small commission to stack a few extra sats.